Tax Rate State Of Mi . Sales taxes are relatively low for the region, and. View the michigan withholding tables. the state of michigan requires you to pay taxes if you’re a resident or nonresident that receives income from a michigan source. treasury's individual income tax (iit) eservice is a platform used by the taxpayer to check refund status, view tax. michigan residents pay an income tax rate of 4.25%. This revised rate is an. the lower 4.05% tax rate applies to all michigan taxable income originating in the 2023 tax year (january 1, 2023 through. the michigan income tax rate is 4.25%. The rate increased in 2008, from 3.90%. This booklet contains information for your 2024 michigan property taxes and 2023 individual. thus, the tax rate applicable to all individuals and fiduciaries for the 2023 tax year is 4.05%. michigan has a flat income tax rate across the state, but some cities do charge an additional rate.

from www.mackinac.org

michigan residents pay an income tax rate of 4.25%. The rate increased in 2008, from 3.90%. Sales taxes are relatively low for the region, and. View the michigan withholding tables. michigan has a flat income tax rate across the state, but some cities do charge an additional rate. This booklet contains information for your 2024 michigan property taxes and 2023 individual. thus, the tax rate applicable to all individuals and fiduciaries for the 2023 tax year is 4.05%. This revised rate is an. the michigan income tax rate is 4.25%. treasury's individual income tax (iit) eservice is a platform used by the taxpayer to check refund status, view tax.

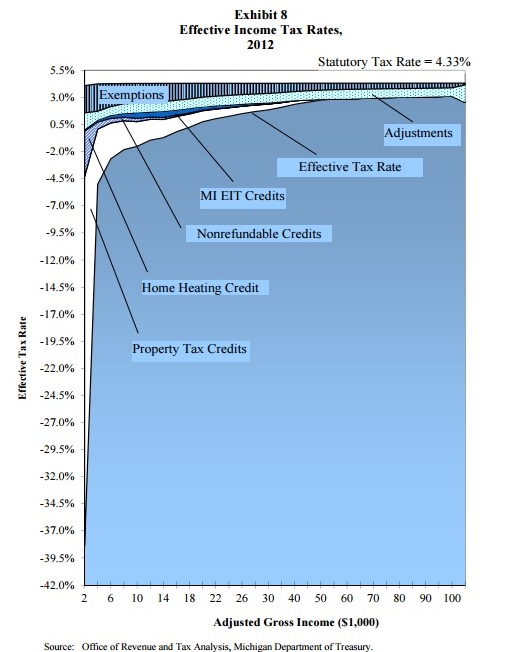

Michigan Taxes Already Progressive Mackinac Center

Tax Rate State Of Mi treasury's individual income tax (iit) eservice is a platform used by the taxpayer to check refund status, view tax. treasury's individual income tax (iit) eservice is a platform used by the taxpayer to check refund status, view tax. thus, the tax rate applicable to all individuals and fiduciaries for the 2023 tax year is 4.05%. This revised rate is an. This booklet contains information for your 2024 michigan property taxes and 2023 individual. View the michigan withholding tables. The rate increased in 2008, from 3.90%. the state of michigan requires you to pay taxes if you’re a resident or nonresident that receives income from a michigan source. michigan has a flat income tax rate across the state, but some cities do charge an additional rate. Sales taxes are relatively low for the region, and. the lower 4.05% tax rate applies to all michigan taxable income originating in the 2023 tax year (january 1, 2023 through. the michigan income tax rate is 4.25%. michigan residents pay an income tax rate of 4.25%.

From livewell.com

What Is The State Of Michigan Tax Rate LiveWell Tax Rate State Of Mi the state of michigan requires you to pay taxes if you’re a resident or nonresident that receives income from a michigan source. treasury's individual income tax (iit) eservice is a platform used by the taxpayer to check refund status, view tax. This booklet contains information for your 2024 michigan property taxes and 2023 individual. the lower. Tax Rate State Of Mi.

From www.mackinac.org

Michigan Taxes Already Progressive Mackinac Center Tax Rate State Of Mi View the michigan withholding tables. michigan residents pay an income tax rate of 4.25%. Sales taxes are relatively low for the region, and. treasury's individual income tax (iit) eservice is a platform used by the taxpayer to check refund status, view tax. michigan has a flat income tax rate across the state, but some cities do. Tax Rate State Of Mi.

From taxfoundation.org

State and Local Sales Tax Rates Midyear 2013 Tax Foundation Tax Rate State Of Mi michigan has a flat income tax rate across the state, but some cities do charge an additional rate. The rate increased in 2008, from 3.90%. This revised rate is an. View the michigan withholding tables. the lower 4.05% tax rate applies to all michigan taxable income originating in the 2023 tax year (january 1, 2023 through. the. Tax Rate State Of Mi.

From www.mortgagerater.com

Michigan Sales Tax Rates and Impact Tax Rate State Of Mi the michigan income tax rate is 4.25%. treasury's individual income tax (iit) eservice is a platform used by the taxpayer to check refund status, view tax. michigan has a flat income tax rate across the state, but some cities do charge an additional rate. This revised rate is an. View the michigan withholding tables. the. Tax Rate State Of Mi.

From www.mlive.com

Will Michigan lower its tax rates? Here’s how we compare to other Tax Rate State Of Mi This revised rate is an. the state of michigan requires you to pay taxes if you’re a resident or nonresident that receives income from a michigan source. This booklet contains information for your 2024 michigan property taxes and 2023 individual. The rate increased in 2008, from 3.90%. michigan has a flat income tax rate across the state, but. Tax Rate State Of Mi.

From taxfoundation.org

2022 Sales Tax Rates State & Local Sales Tax by State Tax Foundation Tax Rate State Of Mi the michigan income tax rate is 4.25%. Sales taxes are relatively low for the region, and. the lower 4.05% tax rate applies to all michigan taxable income originating in the 2023 tax year (january 1, 2023 through. The rate increased in 2008, from 3.90%. michigan has a flat income tax rate across the state, but some cities. Tax Rate State Of Mi.

From www.madisontrust.com

What Is the Most Taxed State? Tax Rate State Of Mi treasury's individual income tax (iit) eservice is a platform used by the taxpayer to check refund status, view tax. michigan has a flat income tax rate across the state, but some cities do charge an additional rate. the state of michigan requires you to pay taxes if you’re a resident or nonresident that receives income from. Tax Rate State Of Mi.

From taxfoundation.org

Property Taxes by County Interactive Map Tax Foundation Tax Rate State Of Mi This booklet contains information for your 2024 michigan property taxes and 2023 individual. the state of michigan requires you to pay taxes if you’re a resident or nonresident that receives income from a michigan source. the michigan income tax rate is 4.25%. michigan has a flat income tax rate across the state, but some cities do charge. Tax Rate State Of Mi.

From usafacts.org

Which states have the highest and lowest tax? Tax Rate State Of Mi This booklet contains information for your 2024 michigan property taxes and 2023 individual. The rate increased in 2008, from 3.90%. the michigan income tax rate is 4.25%. thus, the tax rate applicable to all individuals and fiduciaries for the 2023 tax year is 4.05%. michigan has a flat income tax rate across the state, but some cities. Tax Rate State Of Mi.

From imagetou.com

Tax Rates 2024 2025 Image to u Tax Rate State Of Mi This booklet contains information for your 2024 michigan property taxes and 2023 individual. the michigan income tax rate is 4.25%. Sales taxes are relatively low for the region, and. the state of michigan requires you to pay taxes if you’re a resident or nonresident that receives income from a michigan source. treasury's individual income tax (iit) eservice. Tax Rate State Of Mi.

From www.thebalance.com

A List of Tax Rates for Each State Tax Rate State Of Mi thus, the tax rate applicable to all individuals and fiduciaries for the 2023 tax year is 4.05%. This revised rate is an. the state of michigan requires you to pay taxes if you’re a resident or nonresident that receives income from a michigan source. treasury's individual income tax (iit) eservice is a platform used by the. Tax Rate State Of Mi.

From crcmich.org

Tax Cuts are Coming, but Michigan is Already a LowTax State Citizens Tax Rate State Of Mi michigan residents pay an income tax rate of 4.25%. treasury's individual income tax (iit) eservice is a platform used by the taxpayer to check refund status, view tax. the state of michigan requires you to pay taxes if you’re a resident or nonresident that receives income from a michigan source. This booklet contains information for your. Tax Rate State Of Mi.

From www.researchgate.net

Statewide Average Property tax Millage Rates in Michigan, 19902008 Tax Rate State Of Mi Sales taxes are relatively low for the region, and. the lower 4.05% tax rate applies to all michigan taxable income originating in the 2023 tax year (january 1, 2023 through. thus, the tax rate applicable to all individuals and fiduciaries for the 2023 tax year is 4.05%. michigan has a flat income tax rate across the state,. Tax Rate State Of Mi.

From patch.com

MI Individual Tax Rate Will Return To 4.25 In 2024 Treasurer Tax Rate State Of Mi The rate increased in 2008, from 3.90%. the state of michigan requires you to pay taxes if you’re a resident or nonresident that receives income from a michigan source. This revised rate is an. the michigan income tax rate is 4.25%. thus, the tax rate applicable to all individuals and fiduciaries for the 2023 tax year is. Tax Rate State Of Mi.

From www.thestreet.com

These States Have the Highest Property Tax Rates TheStreet Tax Rate State Of Mi This revised rate is an. Sales taxes are relatively low for the region, and. michigan has a flat income tax rate across the state, but some cities do charge an additional rate. the state of michigan requires you to pay taxes if you’re a resident or nonresident that receives income from a michigan source. View the michigan withholding. Tax Rate State Of Mi.

From wallethub.com

States with the Highest & Lowest Tax Rates Tax Rate State Of Mi This booklet contains information for your 2024 michigan property taxes and 2023 individual. The rate increased in 2008, from 3.90%. thus, the tax rate applicable to all individuals and fiduciaries for the 2023 tax year is 4.05%. Sales taxes are relatively low for the region, and. the state of michigan requires you to pay taxes if you’re a. Tax Rate State Of Mi.

From printable-map-az.com

006 Page1 1200Px State And Local Sales Tax Rates Pdf Michigan Form Tax Rate State Of Mi the state of michigan requires you to pay taxes if you’re a resident or nonresident that receives income from a michigan source. the michigan income tax rate is 4.25%. the lower 4.05% tax rate applies to all michigan taxable income originating in the 2023 tax year (january 1, 2023 through. This revised rate is an. The rate. Tax Rate State Of Mi.

From www.msn.com

Michigan's tax rate can rise in 2024, judge says Tax Rate State Of Mi the state of michigan requires you to pay taxes if you’re a resident or nonresident that receives income from a michigan source. michigan has a flat income tax rate across the state, but some cities do charge an additional rate. michigan residents pay an income tax rate of 4.25%. treasury's individual income tax (iit) eservice is. Tax Rate State Of Mi.